Positioning itself as a “globally recognized broker, ” ATFX (atfx.com) claims to offer premium forex and CFD trading services. However, our investigation reveals concerning patterns that every investor should know before engaging with this platform.

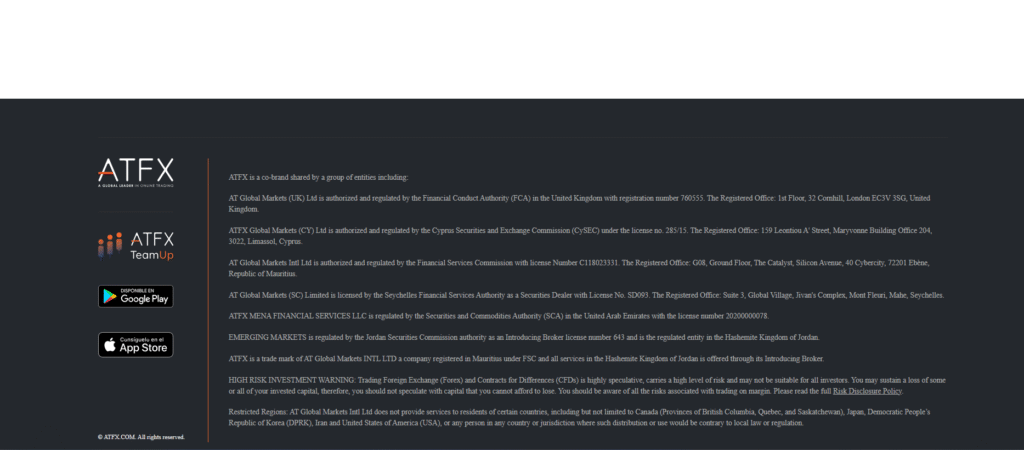

ATFX’s regulatory facade: Licensed but problematic

While ATFX holds licenses in some jurisdictions (FCA UK 760555, CySEC 285/15), multiple user reports suggest these registrations serve more as window dressing than actual protection. The company operates through offshore subsidiaries in places like St. Vincent and the Grenadines for its international clients – a common tactic to avoid strict oversight.

The “professional edge” deception: Reality vs marketing

ATFX advertises “institutional-grade conditions” and “personalized service, ” but traders encounter:

- Slippage issues: Frequent complaints about orders executing at worse prices than shown

- Platform quirks: Unexplained freezing during volatile market conditions

- Hidden costs: Spreads widening dramatically during news events despite “fixed spread” claims

Industry professionals note: Even regulated brokers can employ questionable execution practices.

User experiences: Mixed reviews raise red flags

While ATFX maintains a 4.2 Trustpilot rating, deeper analysis shows:

- Withdrawal delays: Multiple reports of funds taking 5-7 business days despite “24-hour” claims

- Account management pressure: Aggressive upselling of “premium services” with high minimums

- Leverage games: Automatic position closures at 50% margin despite promised 100% stop-out

These patterns suggest ATFX prioritizes profitability over fair trading conditions.

The business model: How ATFX operates

- Regulatory arbitrage: Uses EU/UK licenses for credibility while routing most clients to offshore entities

- Marketing blitz: Heavy spending on sponsorships and “educational” webinars that serve as sales funnels

- Execution nuances: While not outright fraudulent, order filling often favors the house

- Client segmentation: Pushes experienced traders toward less favorable terms

6 reasons for caution with ATFX

- Offshore operations: Most clients land in St. Vincent entity (no investor protection)

- Execution concerns: Frequent slippage complaints during volatility

- Aggressive marketing: High-pressure deposit tactics

- Hidden costs: Unclear swap rates and commission structures

- Leverage traps: Dangerous margin policies for retail traders

- ATFX’s dual nature: Presents as premium broker while operating like typical market maker

How to protect yourself

If trading with ATFX:

- Verify entity: Demand confirmation of which company handles your account

- Test execution: Place small orders during volatile periods to check slippage

- Document everything: Save all trade confirmations and communications

When choosing a broker:

- Compare execution stats: Look for published quality of execution reports

- Avoid offshore routing: Insist on trading under strict jurisdictions

- Start small: Test all aspects before committing significant capital

Final thoughts

ATFX represents the gray area between outright scams and fully trustworthy brokers. While not illegally operating, its business model relies on practices that frequently disadvantage retail traders. Savvy investors should weigh these factors carefully before opening an account.