In evaluating Asx365, it becomes immediately apparent that visual polish alone doesn’t make a trustworthy broker. The homepage of Asx365 might look slick, but under the surface, users encounter limited transparency around fees and hidden restrictions. Asx365 markets itself as a comprehensive trading solution, but closer inspection reveals striking deficiencies in cost clarity and service reliability.

- Asx365 Pricing and Fees: Hidden Costs Abound

- Platform Stability: A Risk for Traders

- Customer Support: Slow and Inefficient

- Asx365 Regulatory Oversight: Concerns Remain

- Educational Resources: Shallow and Limited

- Asx365 Account Types: Few Options, Many Restrictions

- Platform Experience: Sketchy Mobile App

- Asx365 Deposit and Withdrawal: Troublesome Process

- Security Protocols: Basic, But No Peace of Mind

- Comparison: Against the Competition

- Asx365 Final Verdict: More Drawbacks Than Benefits

Asx365 Pricing and Fees: Hidden Costs Abound

One of the most alarming issues with Asx365 is the lack of clear fee structure. The promotional material omits crucial information like overnight financing and currency conversion charges. When clients deposit foreign currency or leave positions open past trading hours, Asx365 quietly deducts additional fees that are nowhere to be found in the initial disclosure. This opaque pricing model raises red flags and indicates a broker more concerned with profit than with client trust.

Platform Stability: A Risk for Traders

Traders depend on stability and reliable execution. Unfortunately, Asx365 often fails to deliver on this front. Numerous user reports cite frequent platform lags and execution delays, especially during volatile market conditions. For a broker that claims to offer professional-grade trading, this technical instability is a serious drawback that undermines client confidence. Asx365 must address these issues or risk alienating seasoned investors.

Customer Support: Slow and Inefficient

Timely support is critical. Yet Asx365 frequently draws criticism for slow response times and unhelpful resolutions. Live chat is often offline, and email inquiries can take days without any meaningful resolution. Some clients report having to explain simple issues multiple times before an adequate response arrives, if at all. Asx365’s lack of reliable customer support threatens its user retention and overall reputation in the highly competitive broker space.

Asx365 Regulatory Oversight: Concerns Remain

Although Asx365 advertises regulatory compliance, the broker’s documentation lacks clarity about jurisdiction and oversight authority. The absence of transparent regulator details concerning Asx365 creates uncertainty about fund protection and dispute mechanisms. Potential users should be aware that lack of clarity here can signal increased risk, particularly with firms operating across borders with ambiguous regulatory standing.

Educational Resources: Shallow and Limited

Effective broker platforms typically offer educational hubs. By contrast, Asx365 provides only cursory guides and limited video content. Their market analysis lacks depth, while webinars and tutorials are infrequent and poorly timed. Investors seeking robust learning tools will find Asx365’s educational offerings severely inadequate, undermining the broker’s claim to support trader development.

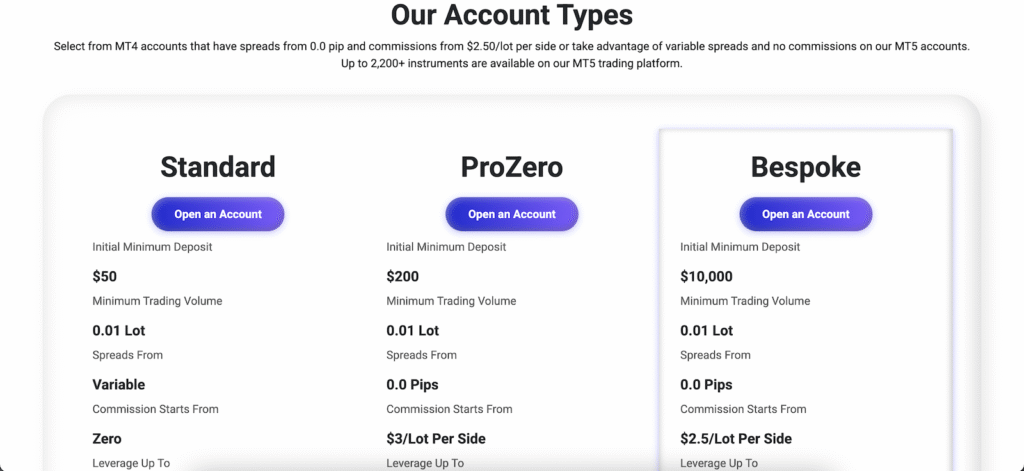

Asx365 Account Types: Few Options, Many Restrictions

A diverse broker caters to varied client needs through flexible account types. Asx365 falls short in this regard, presenting just a couple of generic account options with limited features. The lack of a basic demo account or educational tier can deter entry-level traders. For serious investors seeking tiered services, Asx365’s rigid account structure is a deal-breaker.

Platform Experience: Sketchy Mobile App

While a mobile trading app is essential, Asx365’s offering remains clunky and outdated. Users report frequent crashes, slow update cycles, and poor navigation. Stability in a mobile app is non-negotiable, especially for traders on the go. In its current state, the Asx365 mobile platform is unfit for professional use.

Asx365 Deposit and Withdrawal: Troublesome Process

Clients often report delays and unexplained hold times when withdrawing funds from Asx365. Deposits are generally processed smoothly, but when cash flows outward, Asx365 introduces excess verification or indirect processing. This can lead to funds being locked for days, leaving clients frustrated and worried about liquidity. A reputable broker should facilitate seamless deposits and withdrawals—Asx365 fails to meet that standard.

Security Protocols: Basic, But No Peace of Mind

Security assurances are critical. Asx365 claims SSL encryption and segregated client accounts, but lacks evidence of advanced protocols like two-factor authentication or end-to-end encryption. Minimal password rules and the absence of withdrawal whitelists suggest insufficient precaution. For clients entrusting significant funds, this basic-level security may fall dangerously short.

Comparison: Against the Competition

Compared to industry-leading brokers, Asx365 lacks competitive pricing, robust platforms, and transparent operations. While other brokers offer zero commissions, 24/7 support, strong regulatory backing, and high quality trading infrastructure, Asx365 remains behind the curve. Wealthy and professional traders will find Asx365’s underwhelming services unappealing.

Asx365 Final Verdict: More Drawbacks Than Benefits

In summary, Asx365 fails to deliver on core fundamentals: transparent fees, platform stability, support responsiveness, and regulatory clarity. While no broker is perfect, trading platforms must still uphold baseline standards. For Asx365, the deficiencies are glaring and recurrent.

If you’re considering Asx365, be aware of these significant issues before committing funds. The broker’s superficial appeal masks deeper reliability, cost, and support problems. For serious or professional traders, it’s advisable to seek alternative brokers with clear fee policies, solid infrastructure, transparent regulation, and dependable support.

Stay Safe with Scam Insights from Invests.Finance