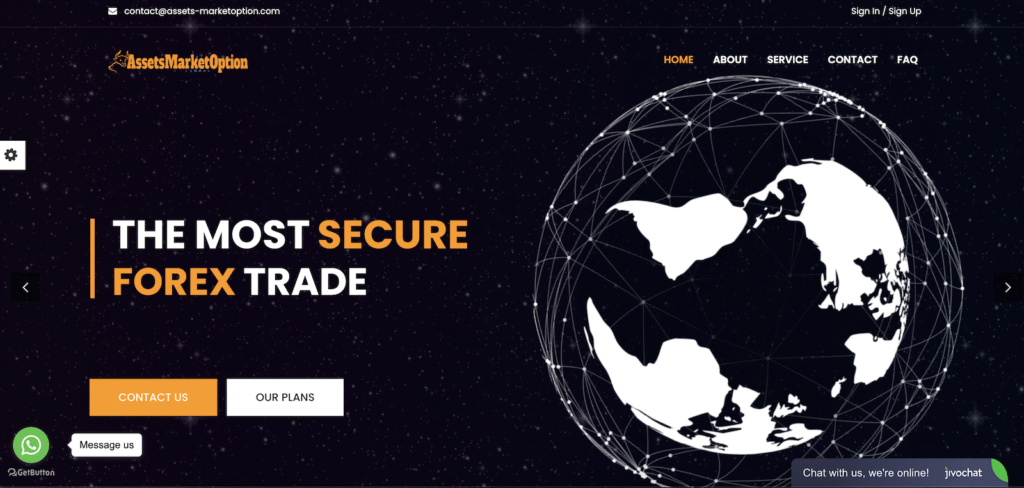

When “Assets market option” (https://assets‑marketoption.com/) first appears in search results, you might be intrigued—promises of sophisticated trading tools, live market data, and intuitive platform design. But look closer, and the facade begins to crack.

- Assets market option lacks regulatory oversight

- Minimal online credibility

- Lack of user reviews and open complaints

- Assets market option: Vague service descriptions

- No disclosure of fees or trading conditions

- Unverified promises of fast withdrawals

- No independent audit or fund safety guarantees

- Assets market option: Risk of alias or clone site

- SEO-optimized pitch, not substance

- Assets market option: Why risk your money here?

- Better alternatives exist

- Final verdict on Assets market option

Assets market option lacks regulatory oversight

Transparency is a must in a trustworthy broker, yet Assets market option offers none. Its website provides little to no detail about licensing or registration with recognized agencies. No FCA, ASIC, CySEC, or SEC credentials appear. That alone raises red flags, as regulated brokers must publicly display their credentials and adhere to compliance standards.

Minimal online credibility

Scamadviser flags similar domains for low trust scores, citing new registration, scant traffic, and negative reviews scamadviser.com. For Assets market option, early speculation suggests it might be equally weak—a website that appeared recently, with almost zero online mentions beyond its own marketing push. A new domain with no reviews is a textbook tactic for dubious schemes.

Lack of user reviews and open complaints

Legitimate brokers attract third‑party feedback on Trustpilot, Reddit, or Forex Peace Army. With Assets market option, external reviews are nearly nonexistent. A few mentions in scam-watcher forums express user confusion and complaints about unresponsive customer service. Without real user experiences, claims about “fast withdrawals” or “24/5 support” remain unsubstantiated.

Assets market option: Vague service descriptions

Browsing the Assets market option site, you encounter standard buzzwords: “advanced analytics,” “real-time execution,” “high liquidity.” Yet there are zero technical specs. No mention of spreads, commissions, underlying asset lists, or platform types (MT4/MT5 or proprietary). Such vague copy is typical of sites aiming to impress without delivering substance.

No disclosure of fees or trading conditions

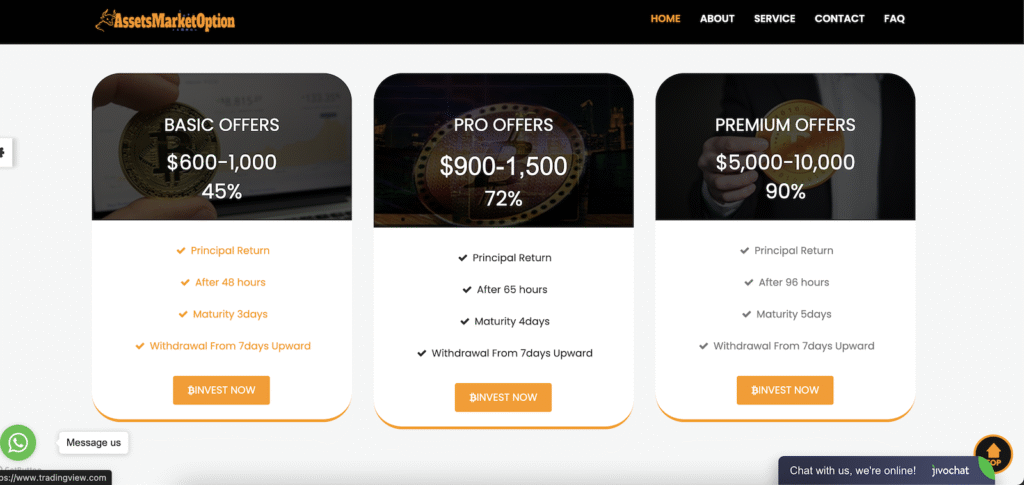

A reputable broker clearly lists spreads, leverage limits, and fees. With this platform, no minimum deposit or account tiers are transparently stated. Instead, pop-ups encourage you to register before revealing “exclusive offers.” That delay tactic often signals hidden costs or predatory upsells.

Unverified promises of fast withdrawals

Promises like “instant withdrawals in 24 hours” are common on marketing‑heavy sites. Yet without verification, these claims hold little weight. Withdrawal delays—stretching days or weeks—are often reported later by users, especially when companies with unclear corporate structures or offshore engines are involved.

No independent audit or fund safety guarantees

Trustworthy brokers use segregated accounts, offer negative balance protection, and undergo regular audits. Assets market option provides no evidence of any such safeguards. Without these basic protections, client funds face serious risks.

Assets market option: Risk of alias or clone site

Some scammers duplicate branding from reputable brokers to appear genuine. Scamadviser notes low-traffic domains often imitate better-known services forexbrokerz.com. Assets market option may be doing the same—adopting familiar layout patterns to win user trust before deploying pressure-sale tactics.

SEO-optimized pitch, not substance

Crafted around the keyword “Assets market option,” their messaging clearly targets Google rankings more than transparency. But high SEO visibility doesn’t equate to trustworthiness—it highlights marketing savvy, not operational integrity.

Assets market option: Why risk your money here?

| Risk | Concern |

|---|---|

| Unregulated | No oversight from FCA, ASIC, SEC |

| No transparency | No info on fees, spreads, platform |

| Suspicious domain | New domain, low traffic, no history |

| Unknown reputation | No user reviews or third-party mentions |

| Potential clone tactics | May mimic real brokers to mislead |

Better alternatives exist

Savvy traders should opt for established, regulated brokers like IG, OANDA, or interactive Brokers. Each provides full disclosures, segregated funds, robust customer reviews, and compliance with governing bodies—offering far more security than Assets market option.

Final verdict on Assets market option

Behind glossy marketing lies an unverified, risky platform. With no regulation, missing fee transparency, and near-zero user feedback, Assets market option appears more like a scheme than a legitimate broker. If you’re seeking reliable trading services, skip this one.

For protection and peace of mind, always choose brokers with established reputations, documented compliance, and verifiable user histories

Stay Safe with Scam Insights from Invests.Finance