In the vast landscape of online trading platforms, Assets Management Options (https://assmanopt.live/) positions itself as a forex broker offering low spreads and high dynamic leverage. While these features might seem appealing to traders, a closer examination reveals several concerns that potential users should consider before engaging with the platform.

- Assets Management Options Background and Regulatory Standing

- Trading Conditions and Account Types

- Leverage and Risk Implications

- Deposit and Withdrawal Policies

- Trading Instruments and Tools

- Customer Support and Educational Resources

- Assets Management Options: User Reviews and Reputation

- Security Measures

- Conclusion on Assets Management Options

Assets Management Options Background and Regulatory Standing

A fundamental aspect of any trading platform is its regulatory status. Unfortunately, Assets Management Options lacks transparency regarding its regulatory framework. The absence of clear information about regulatory oversight raises questions about the platform’s adherence to industry standards and investor protection protocols.

Trading Conditions and Account Types

The platform offers various account types, each with distinct features:

- Classic Account: Requires a minimum deposit of $5,000, with spreads starting at 1.5 pips and leverage up to 1:3000.

- Pro Account: Demands a $10,000 minimum deposit, features zero spreads, and charges a $3 commission per lot.

- VIP Account: Needs a $30,000 minimum deposit, offers zero spreads, and charges a $1.50 commission per lot.

While these conditions might attract seasoned traders, the high minimum deposit requirements could be a barrier for beginners. Additionally, the platform’s fee structure, including commissions and potential hidden costs, warrants careful consideration.

Leverage and Risk Implications

Offering leverage up to 1:3000 is a double-edged sword. While high leverage can amplify profits, it equally increases the potential for significant losses. Such high leverage is often associated with higher risk, and without proper risk management tools and education, traders might find themselves exposed to substantial financial peril.

Deposit and Withdrawal Policies

The platform advertises zero fees on deposits and withdrawals. However, it’s essential to scrutinize the fine print, as some brokers might incorporate hidden fees elsewhere, such as in conversion rates or through less favorable exchange rates. Transparency in these areas is crucial for maintaining trust and ensuring that traders receive the full value of their transactions.

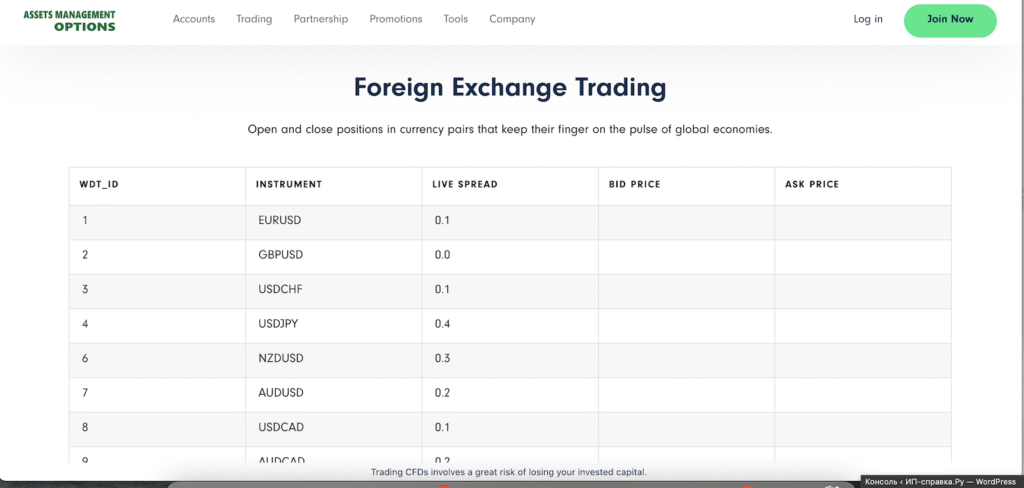

Trading Instruments and Tools

Assets Management Options provides access to various trading instruments, including forex, stocks, cryptocurrencies, indices, metals, and oil. While this diversity can appeal to traders looking for a broad range of options, the quality and reliability of the trading tools and platforms offered are paramount. Without robust and user-friendly tools, even a wide array of instruments can become challenging to navigate effectively.

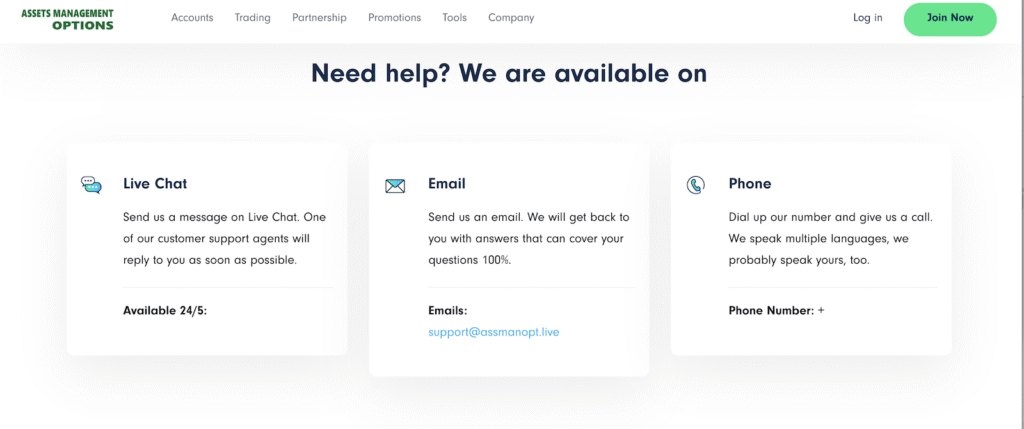

Customer Support and Educational Resources

Effective customer support and comprehensive educational resources are vital for traders, especially those new to the market. Assets Management Options does not provide detailed information about its customer service channels or educational offerings. The lack of accessible support and training materials could hinder users from maximizing the platform’s potential and resolving issues promptly.

Assets Management Options: User Reviews and Reputation

A critical aspect of evaluating any platform is considering user feedback. Currently, there is a lack of independent user reviews and testimonials for Assets Management Options. The absence of third-party reviews makes it challenging to assess the platform’s reliability and user satisfaction. Prospective traders should exercise caution and seek out verified user experiences before committing significant funds.

Security Measures

The security of user data and funds is paramount in online trading. Assets Management Options does not provide detailed information about its security protocols, such as encryption methods or insurance policies. Without clear security measures in place, traders may be at risk of data breaches or unauthorized access to their accounts.

Conclusion on Assets Management Options

While Assets Management Options presents itself as an attractive platform with low spreads and high leverage, several concerns merit careful consideration. The lack of regulatory transparency, high minimum deposit requirements, potential hidden fees, and limited customer support are significant factors that could impact a trader’s experience. Prospective users should conduct thorough research, consider alternative platforms with established reputations, and assess their risk tolerance before engaging with this broker.

Stay Safe with Scam Insights from Invests.Finance