Assets Fund presents itself as a promising investment platform, offering asset-based investments with the goal of high returns. However, despite its attractive website and claims of profitability, a closer look reveals several issues that raise serious concerns for potential investors.

Assets Fund: Transparency and Investment Strategy

One of the platform’s main selling points is its diversified investment options. However, Assets Fund lacks transparency about how these assets are selected and managed. Investors are left with little understanding of the investment strategies being employed, making it hard to gauge whether the returns are sustainable or simply designed to attract new users.

Hidden Fees and Costs

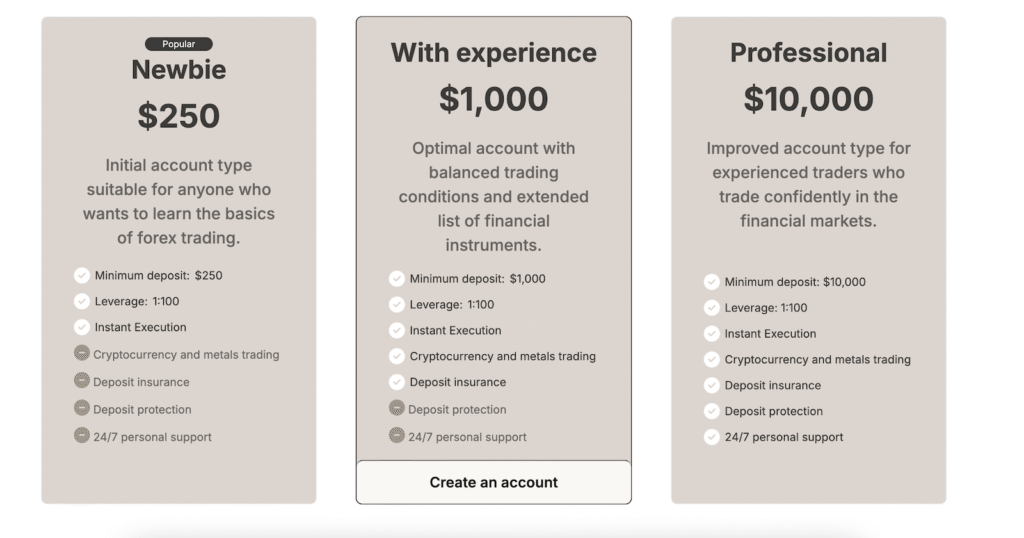

A significant drawback of Assets Fund is its unclear fee structure. While the platform claims to offer a cost-effective service, many users report unexpected charges, including high withdrawal fees and undisclosed management fees. These hidden costs erode potential profits, making the platform less appealing compared to other investment options.

Customer Service Issues

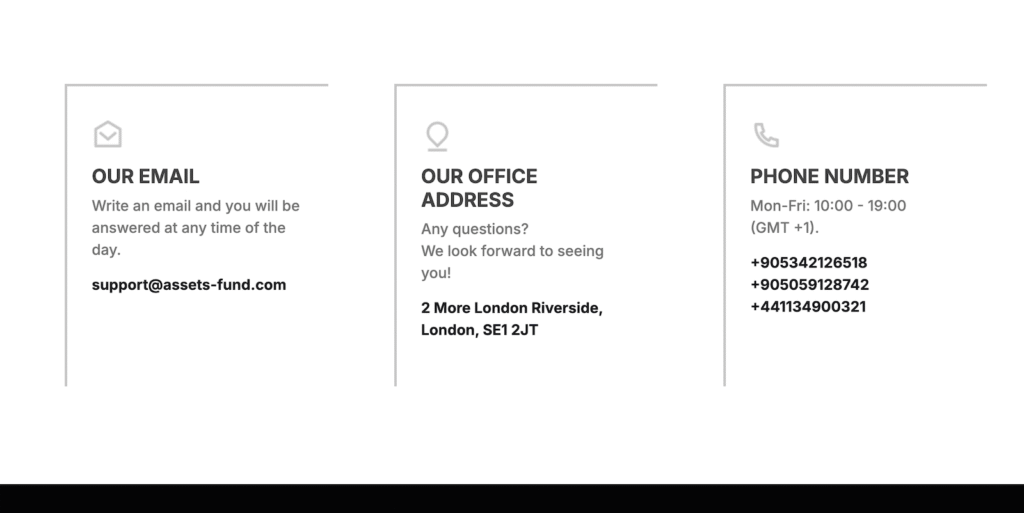

Another major issue is the platform’s subpar customer service. Users often report long response times and generic, unhelpful replies. When dealing with investment concerns or account issues, fast and effective customer support is critical, but Assets Fund fails to deliver in this area, leaving many investors frustrated.

Assets Fund: Security Concerns

While Assets Fund states that it has robust security measures in place, there is no third-party audit or verification to support these claims. In an era where cyberattacks are prevalent, the lack of verifiable security raises doubts about the platform’s ability to protect users’ investments effectively.

Unclear Asset Performance

Perhaps the most worrying aspect of Assets Fund is the lack of verifiable performance data. The platform does not provide historical data on its assets, making it difficult for investors to assess the risk and return of their investments. Without this critical information, it’s impossible to determine if Assets Fund is a reliable long-term investment option.

The Competition: How Does Assets Fund Compare?

Compared to other platforms, Assets Fund falls short. Many competitors offer clear fee structures, transparent performance data, and better customer service. Until Assets Fund addresses these issues, it will remain at a disadvantage in a competitive market.

Conclusion: Should You Invest in Assets Fund?

In conclusion, Assets Fund presents several risks that potential investors should carefully consider. From unclear fees to poor customer service and a lack of transparency, the platform does not provide the reliability and trustworthiness needed for a secure investment. While not outright fraudulent, it’s a platform that should be approached with caution. If you’re looking for a secure, transparent investment platform, there are better options available.

Stay Safe with Scam Insights from Invests.Finance