The Australian Securities and Investments Commis2esion (ASIC) is Australia’s integrated corporate, markets, financial services, and consumer credit regulator. Established under the Australian Securities and Investments Commission Act 2001 (ASIC Act), ASIC operates independently as an Australian Government body. Its primary mission is to maintain, facilitate, and improve the performance of the financial system and entities in it, while promoting confident and informed participation by investors and consumers in the financial system.

- ASIC’s Core Responsibilities

- 1. Corporate Regulation

- 2. Financial Services Licensing

- 3. Market Integrity and Enforcement

- 4. Consumer Protection and Financial Literacy

- ASIC’s Technological Initiatives

- ASIC’s Role in Superannuation

- ASIC’s Enforcement Actions

- Challenges and Criticisms

- Future Outlook

- Conclusion on Australian Securities and Investments Commission (ASIC)

ASIC’s Core Responsibilities

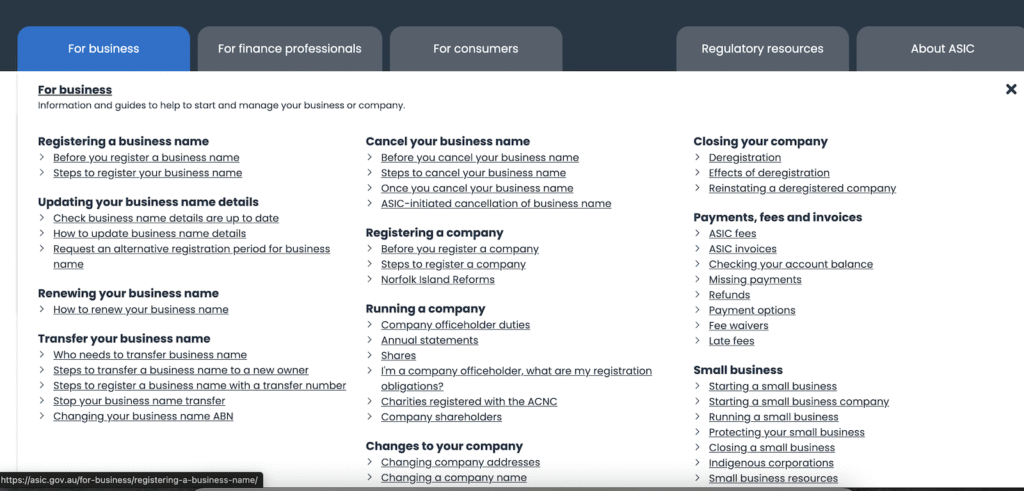

1. Corporate Regulation

ASIC oversees the conduct and disclosure obligations of financial services providers, including superannuation trustees of registrable superannuation entities. It ensures that companies comply with the Corporations Act 2001 and the Australian Securities and Investments Commission Act 2001, promoting transparency and accountability in corporate operations.

2. Financial Services Licensing

One of ASIC’s key roles is to issue Australian Financial Services (AFS) licenses to financial service providers. The process ensures that applicants display the competency required to provide the financial services specified in their application and have ample financial resources to provide the proposed business services. Obtaining an AFS license involves a thorough assessment and can incur costs exceeding $20,000, with ongoing compliance reviews ranging between $8,000 to $25,000 annually.

3. Market Integrity and Enforcement

ASIC plays a crucial role in maintaining fair, transparent, and efficient financial markets. It supervises real-time trading on Australia’s licensed equity, derivatives, and futures markets to detect and prevent market misconduct. The commission has significant enforcement powers, including investigating financial misconduct, issuing fines, bans, or even criminal charges, and taking legal action to recover lost assets or compensate victims.

4. Consumer Protection and Financial Literacy

Protecting consumers in the financial system is a cornerstone of ASIC’s mission. The commission promotes financial literacy through initiatives aimed at improving the financial knowledge and skills of Australians. These programs help individuals make informed decisions about investments and financial services, contributing to a more resilient economy.

ASIC’s Technological Initiatives

Recognizing the impact of technology on the financial industry, ASIC has embraced innovative approaches to fulfill its regulatory duties. The commission employs advanced technologies such as data analytics, artificial intelligence, and blockchain to monitor market activities, detect anomalies, and ensure compliance. This tech-driven approach enhances regulatory efficiency and positions ASIC at the forefront of adapting to the rapidly evolving landscape of financial technology.

ASIC’s Role in Superannuation

ASIC is the conduct regulator for superannuation, focusing on trustee conduct that affects superannuation fund members. Its responsibilities include undertaking supervision and surveillance activities about trustees’ conduct and disclosure obligations, taking enforcement action in response to non-compliance, assessing Australian financial service (AFS) licence applications, and providing guidance to the industry. Recent legislative reforms have expanded ASIC’s role in superannuation, aiming to improve its effectiveness as the conduct regulator and increase consumer protection powers.

ASIC’s Enforcement Actions

ASIC wields significant enforcement powers to ensure compliance and deter wrongdoing. The agency has taken action against major financial institutions for misconduct, including issuing fines and pursuing legal proceedings. For instance, ASIC has actively countered greenwashing, enforcing honesty in environmental claims, and has launched legal proceedings against companies making misleading sustainability statements.

Challenges and Criticisms

Despite its pivotal role, ASIC has faced criticism regarding its effectiveness in handling corporate misconduct. A recent parliamentary inquiry recommended splitting ASIC into two separate bodies after it was found to have “comprehensively” failed in its regulatory duties. The inquiry criticized ASIC for being more focused on managing its reputation than taking enforcement actions against corporate misconduct. It identified structural, resourcing, and cultural issues as key factors hindering its effectiveness.

Future Outlook

Looking ahead, ASIC is poised to continue adapting to the evolving financial landscape. The commission is focusing on emerging areas such as digital currencies, climate risk disclosures, and cybersecurity to ensure that the financial system remains robust and trustworthy. Through its ongoing efforts, ASIC aims to enhance investor confidence and protect consumers in an increasingly complex financial environment.

Conclusion on Australian Securities and Investments Commission (ASIC)

The Australian Securities and Investments Commission (ASIC) plays a crucial role in regulating Australia’s financial system. While it faces challenges and criticisms, its ongoing efforts to adapt to technological advancements and emerging financial trends underscore its commitment to maintaining market integrity and protecting consumers. For businesses and individuals seeking to navigate the Australian financial landscape, understanding ASIC’s functions and staying informed about its regulations is essential.