In the competitive world of online trading, choosing a reliable and trustworthy platform is paramount. One such platform that has recently garnered attention is Asetsholding. Despite its promises of a professional trading experience and a wide array of financial services, a closer examination reveals several concerns that potential investors should consider before engaging with this company.

Asetsholding: Company Background and Legitimacy

Asetsholding presents itself as a leader in financial asset management and consulting, boasting over 10 years of experience and a team of more than 280 professionals. However, concrete evidence supporting these claims is notably absent. The company’s website lacks detailed information about its history, leadership team, and physical presence, which are critical factors in establishing credibility in the financial sector.

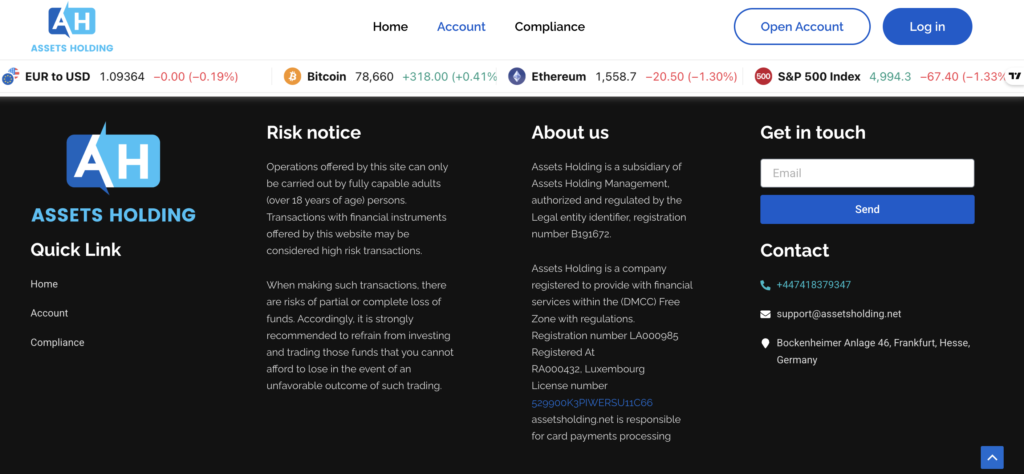

Furthermore, the regulatory status of Asetsholding is ambiguous. The company asserts that it is authorized and regulated by a “Legal entity identifier” with registration number B191672. However, this information is vague and does not correspond to any well-known regulatory authority. The mention of a license number linked to Luxembourg adds to the confusion, especially when the company’s contact address is listed in Frankfurt, Germany. This lack of clear and verifiable regulatory oversight raises significant red flags about the company’s legitimacy.

Website and Online Presence

Asetsholding’s official website, asetsholding.com, is the primary source of information about the company’s services. While the site is visually appealing, it lacks depth in content and transparency. Essential details such as the company’s physical address, leadership biographies, and comprehensive service descriptions are missing. Additionally, the website’s domain was registered recently, which contradicts the company’s claim of over a decade of experience in the industry.

The website also provides links for opening accounts and logging in, directing users to assetsholding.net. This use of multiple domains can be confusing and is often a tactic employed by less reputable entities to obscure their operations. Moreover, the site lacks robust security features, which is concerning given the sensitive nature of financial transactions.

Services Offered

Asetsholding claims to offer a comprehensive suite of trading services, including CFDs on shares, commodities, indices, metals, currency pairs, and cryptocurrencies. They highlight features such as instant order execution, anti-slippage technology, and a wide choice of analytical tools. However, without verifiable client testimonials or third-party reviews, it’s challenging to assess the effectiveness and reliability of these services.

The company also emphasizes educational resources, including training courses and market analysis. Yet, access to these materials appears to be restricted, and there is little information about the qualifications of the individuals providing this content. This opacity makes it difficult for potential clients to gauge the quality and value of the educational offerings.

Customer Support and Accessibility

Effective customer support is crucial in the trading industry. Asetsholding claims to offer 24/7 customer service, but the only contact information provided is a UK phone number and an email address. There is no live chat feature or physical office location listed, which limits the avenues through which clients can seek assistance. This lack of accessible and responsive customer support can be a significant drawback for traders who require timely help.

Regulatory Compliance and Risk

The financial industry is heavily regulated to protect investors and ensure fair practices. Asetsholding’s ambiguous regulatory status is a major concern. Engaging with an unregulated or poorly regulated entity exposes investors to heightened risks, including the potential loss of funds without recourse. The company’s risk notice acknowledges the high-risk nature of their offered transactions but does little to assure clients of any protective measures or compensation schemes in place.

Conclusion about Asetsholding

While Asetsholding markets itself as a seasoned player in financial asset management and consulting, the lack of transparency, unclear regulatory status, and limited verifiable information raise significant concerns. Potential investors should exercise extreme caution and conduct thorough due diligence before considering any engagement with Asetsholding. In the realm of online trading, it is imperative to prioritize platforms that are transparent, well-regulated, and have a proven track record of reliability and client satisfaction.