In the ever-evolving world of online trading, numerous platforms promise unparalleled services and returns. One such platform is Alliance Stocks, accessible via https://alliancestocks.com/. While it presents itself as a comprehensive trading solution, a closer examination reveals several areas of concern that potential investors should be aware of.

Alliance Stocks: Lack of Regulatory Oversight

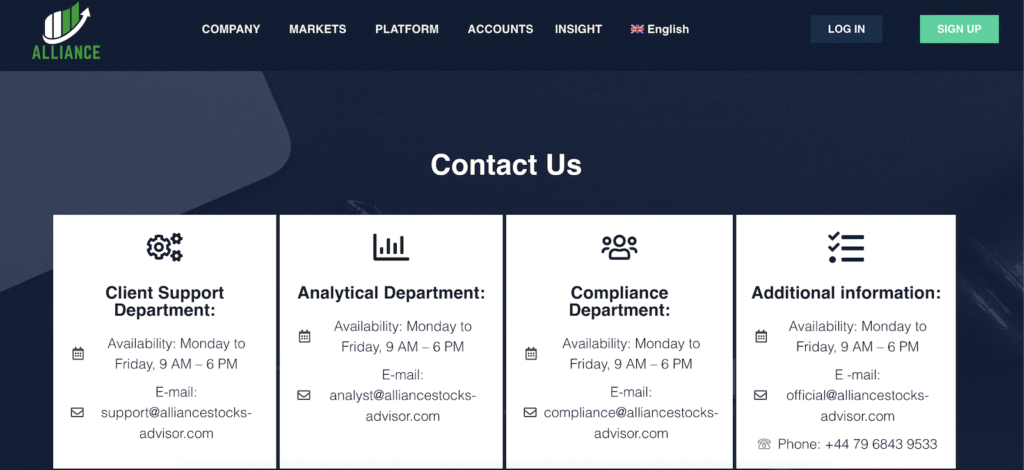

A primary concern with Alliance Stocks is the absence of clear regulatory information. Legitimate trading platforms typically operate under the supervision of recognized financial authorities, ensuring compliance with industry standards and providing a layer of protection for investors. Alliance Stocks, however, does not prominently display any affiliations with such regulatory bodies on its website. This omission raises questions about the platform’s legitimacy and the safety of funds invested through it.

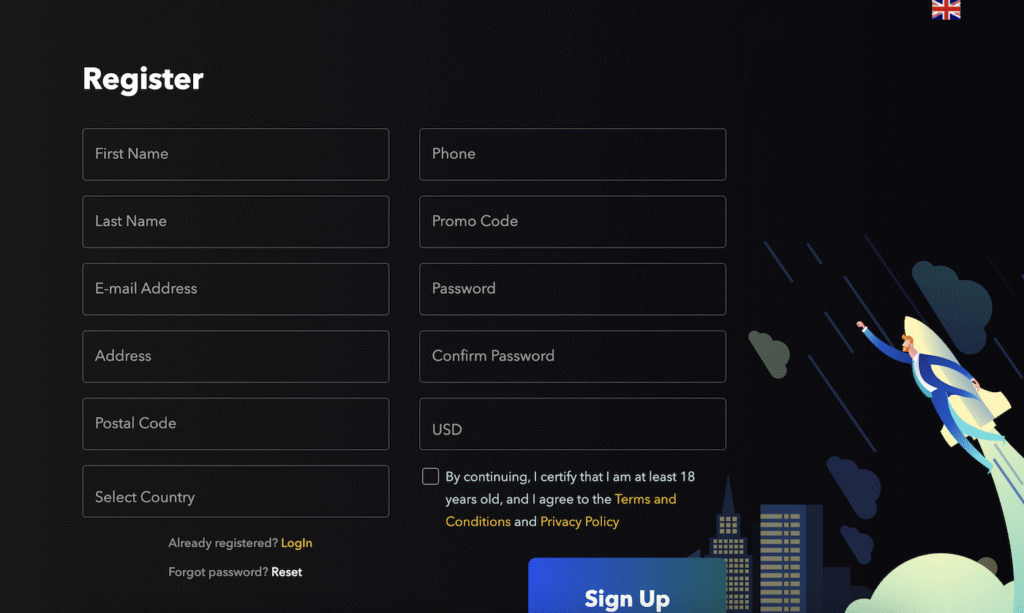

Ambiguous Company Information

Transparency is crucial in the financial sector. Alliance Stocks provides limited information about its corporate structure, leadership, or physical headquarters. The “About Us” section offers generic statements without delving into specifics about the company’s history or team. Such vagueness can be a red flag, as reputable firms usually offer detailed insights into their operations and management.

Questionable Customer Testimonials

Alliance Stocks boasts a 95.7% customer satisfaction rate, claiming that 9 out of 10 clients would recommend their services. However, these statistics lack verifiable sources or methodologies. Without third-party validation or detailed survey data, it’s challenging to assess the authenticity of these claims. In an industry where trust is paramount, unverifiable testimonials can be misleading.

Potentially Misleading Marketing Practices

The platform emphasizes features like “negative balance protection” and “segregated accounts,” suggesting a high level of security for investors. While these features are standard among reputable brokers, their mere mention without detailed explanations or evidence of implementation can be misleading. Furthermore, the promise of “extra security for big funding” up to $1 million lacks clarity on the mechanisms or insurance policies in place to support such claims.

Alliance Stocks: Limited Trading Platform Details

Alliance Stocks promotes its proprietary “Webtrader” platform, highlighting features like instant trading, advanced charts, and mobile compatibility. However, there is a lack of comprehensive information about the platform’s functionalities, user interface, or comparisons with industry-standard platforms like MetaTrader 4 or 5. Potential users are left without a clear understanding of the tools and resources available to them.

Absence of Educational Resources

For novice traders, educational materials are invaluable. Alliance Stocks offers sections on technical, fundamental, and sentiment analysis, but these resources appear superficial. There is a noticeable absence of in-depth tutorials, webinars, or interactive learning modules that can equip traders with the necessary skills and knowledge. This gap suggests that the platform may not be adequately supporting its users’ growth and development.

Conclusion on Alliance Stocks

While Alliance Stocks presents itself as a comprehensive trading platform, several aspects raise concerns about its credibility and commitment to investor safety. The lack of regulatory transparency, ambiguous company information, potentially misleading marketing, and insufficient educational resources are significant drawbacks. Prospective investors should exercise caution and conduct thorough due diligence before engaging with the platform.

Stay Safe with Scam Insights from Invests.Finance