In the competitive world of online trading, Admiralmarkets has built a reputation as a reliable and transparent brokerage provider. We have carefully analyzed Admiralmarkets to understand whether it meets the expectations of active traders, investors, and beginners seeking stable market access.

Admiralmarkets operates as a global brokerage brand offering access to Forex, stocks, indices, commodities, ETFs, and cryptocurrencies. The company has positioned Admiralmarkets as a technology focused broker with strong regulatory backing and diversified account options. For traders searching in Google for a trustworthy brokerage platform, Admiralmarkets frequently appears among the most discussed names.

The primary reason Admiralmarkets continues to gain attention is its structured approach to compliance, platform development, and client education. We see that Admiralmarkets aims to combine professional trading conditions with accessible tools for retail clients.

Regulation and Security at Admiralmarkets

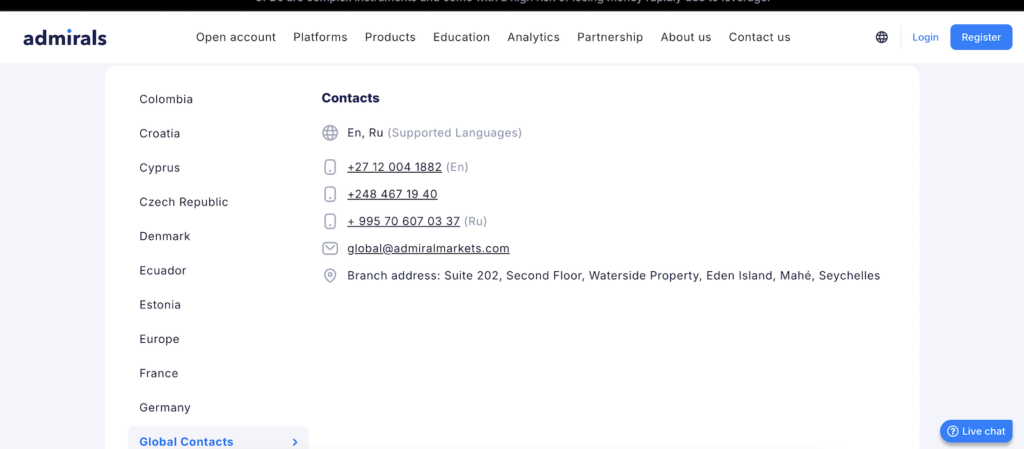

Security remains one of the first concerns for anyone entering the financial markets. Admiralmarkets operates through regulated entities in multiple jurisdictions, including oversight by reputable European authorities. This regulatory framework gives Admiralmarkets credibility and increases client confidence.

We examined how Admiralmarkets handles client funds and risk disclosures. The broker states that it segregates client funds from operational accounts. This approach aligns with industry standards and adds a layer of financial transparency. Admiralmarkets also provides negative balance protection for retail traders in certain regions, which limits risk exposure during volatile market conditions.

From our evaluation, Admiralmarkets demonstrates a clear commitment to compliance, which is an important factor for traders comparing brokerage options online.

Trading Platforms Offered by Admiralmarkets

Technology is a core strength of Admiralmarkets. The broker provides access to MetaTrader 4 and MetaTrader 5 platforms, both widely recognized in the trading industry. Through Admiralmarkets, clients can access advanced charting tools, automated trading capabilities, and customizable indicators.

We noticed that Admiralmarkets enhances the standard MetaTrader environment with additional tools and plugins. These add ons are designed to improve risk management and market analysis. Admiralmarkets also offers web based access and mobile applications, allowing traders to monitor positions from any location.

Execution speed and platform stability are critical for active traders. During our research, Admiralmarkets showed competitive execution conditions, particularly for Forex and index trading.

Account Types and Trading Conditions at Admiralmarkets

Admiralmarkets provides several account structures tailored to different trading styles. Retail clients can choose between standard accounts with competitive spreads and professional accounts for more experienced traders. Admiralmarkets also offers Islamic accounts for clients who require swap free trading conditions.

Minimum deposit requirements at Admiralmarkets are relatively accessible compared to many international brokers. This lowers the entry barrier for new market participants. Spreads and commissions vary depending on the account type and instrument, but Admiralmarkets generally positions itself within competitive market ranges.

Leverage levels depend on regulatory jurisdiction. Admiralmarkets complies with regional leverage restrictions, particularly within the European Union. While higher leverage may be available outside certain regions, we always encourage traders to evaluate risk carefully before using leveraged products through Admiralmarkets.

Educational Resources and Research at Admiralmarkets

Education plays an essential role in client retention. Admiralmarkets invests significantly in educational content, including webinars, market analysis, and written guides. For beginners searching online for trading tutorials, Admiralmarkets provides structured materials that cover technical and fundamental analysis.

We found that Admiralmarkets frequently publishes market updates and trading insights. These resources help traders understand macroeconomic events and potential market volatility. By integrating research and education, Admiralmarkets supports both short term and long term trading strategies.

Such educational initiatives make Admiralmarkets attractive to users who want more than just a trading interface.

Fees and Transparency at Admiralmarkets

Cost transparency is another factor that traders analyze before choosing a broker. Admiralmarkets outlines its spreads, commissions, and swap rates on its official website. While spreads can fluctuate based on market conditions, Admiralmarkets maintains competitive pricing compared to many global competitors.

Inactivity fees and withdrawal policies should always be reviewed carefully. Admiralmarkets provides clear documentation regarding these charges. We recommend that potential clients read the full terms before opening an account with Admiralmarkets to avoid misunderstandings.

Overall, Admiralmarkets demonstrates a transparent fee structure, which strengthens its position among established brokerage providers.

Who Should Consider Admiralmarkets

Admiralmarkets may be suitable for retail traders, intermediate investors, and even professionals who value regulatory oversight and advanced trading platforms. The combination of MetaTrader integration, diversified instruments, and educational support positions Admiralmarkets as a balanced brokerage option.

We believe Admiralmarkets is particularly attractive to traders who prioritize regulation, platform functionality, and structured market access. However, as with any financial service provider, traders should evaluate personal risk tolerance and financial objectives before committing capital to Admiralmarkets.

Final Thoughts on Admiralmarkets

After detailed analysis, Admiralmarkets stands out as a regulated and technology driven brokerage platform. Admiralmarkets offers access to global financial markets, competitive spreads, and strong educational resources. For traders actively searching for a broker through Google, Admiralmarkets presents a comprehensive solution that balances accessibility with professional trading tools.

We encourage potential users to explore Admiralmarkets carefully, review the available account types, and test the platform through a demo account. If you are considering opening a trading account, share your questions or experience in the comments. Our team will gladly provide further insights to help you decide whether Admiralmarkets aligns with your investment goals.